Payment Processing can be a tricky landscape to navigate, especially when it comes to pricing. With all the different models and jargon that’s used it’s easy to get lost in all the numbers. But it’s important to be able to distinguish between these figures because at the end of the day, it’s your sales and money. One particular model that’s become more prevalent is interchange plus pricing.

What is Interchange Plus Pricing?

Let’s start first by talking about Interchange rates. The interchange rate is the cost of a credit card as set by the different card networks. Visa and Mastercard set these rates for every card and these costs remain the same for all businesses. The costs of specific cards can vary according to the rewards, points, and perks attached to them. Generally they fall within the 0.92% – 2.5% range.

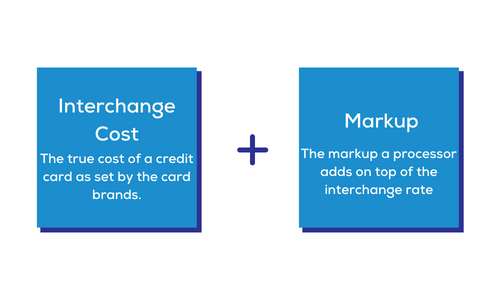

Interchange plus pricing shows the interchange rates, or costs, of all the specific credit cards a business will accept plus the markup a processor adds on top of that. It clarifies just how much goes to the card brand networks and your processor in every transaction.

How does interchange plus pricing help your business?

- It provides transparency into your processing

As simple as this might sound, it is an issue within the processing industry. Often you hear about hidden fees, inflated rates and some sort of “catch.” It’s a lot easier to add on these kinds of fees when you don’t know exactly how much your processor makes on your sales. Whenever there’s a gray area in markups, it’s easier to increase them. Interchange plus pricing makes it clear just how much of your sales goes to the card brand networks (Visa, Mastercard, etc.) and what goes to your processor.

- It makes processing easier to understand

When you work just with the interchange rate and set markups it becomes a lot easier to know what your processing costs will be. The interchange rates will vary depending on the cards you accept but the markups for these cards remain the same. This consistency enables you to better predict and budget your processing costs accordingly. Interchange plus also allows you to adequately compare processing costs across processors. Since you know the interchange rates remain the same for all businesses, the real variations in rates can be attributed to your processor’s markup. Essentially, you’re getting more clear and actionable information to work with whenever your business receives interchange plus pricing.

- It adds to your bottom line

Finally and most importantly, interchange plus pricing adds to your overall profits. As mentioned above, when it’s clear exactly what all parties make in your processing, it’s tougher to add on additional hidden fees. These in turn keep your costs down and let you keep more of your sales.

When it comes to processing, you want to make sure that you’re getting honest and simple pricing. Interchange plus pricing provides the transparency and simplicity needed to get the most out of your sales. At the end of the day, it’s your money, you deserve to understand where it’s going to and why. JAZ Payments aims to provide just that with honest pricing and no contracts. Get started today and let’s help you keep more of your sales in your pocket where it belongs.